I'm not for raising income tax rates. I'm almost never for raising any taxes. If a government entity really doesn't have enough money, and they can't raise enough money with bake sales to build their bombs, roads, sewers, or schools, then maybe, but that instance is so rare that it's not really worth discussing.

Besides that, letting the Bush tax cuts expire is counterproductive. Raising taxes on just the rich from 35% to 39.6% would increase revenue little, if any. The wealthy have the most elastic wages of all income groups. If you raise taxes on someone living paycheck-to-paycheck, you can get more revenue, because not only will they have to pay the taxes, they will have to work more to make up the lost income. The wealthy are much more likely to be in a position to choose whether or to absorb the hit, increase their income (through working more or whatever) to make up for it, or reduce their income due to the reduced incentive. A 4.6% tax increase wouldn't reduce incentives for very many wealthy people, but the marginal ones might make a difference in this recession.

All that being said, the Republicans in Congress should let Bush tax cuts expire. Basically, the agreement has been to extend the Bush tax cuts by two years, spend a lot of Federal dollars on stimulus measures that the President has wanted for some time, and add enough pork to buy off enough Democratic Congresscritters to get it passed. This isn't a good deal. Republican voters should demand more. Sure, taxes will go up January 1, but if the newly-elected Republican House gets on it and passes a better tax bill immediately, workers might only see the taxes for one paycheck. If only there were a ready-made tax plan that reduced rates for almost everyone, would have a stimulative effect on the economy, and reduced the deficit...

... Oh yeah, the plan from the President's Debt Commission. In a rare fit of sanity, the White House appointed a debt commission that ended up recommending a flatter income tax system with tax brackets of 9%, 15%, and 24%, and a corporate income tax rate reduced from an insane 35% to a still uncompetitive, but less onerous 24%. It'll increase revenue by including capital gains as income, and significantly reducing the number of deductions, but almost every taxpayer will end up taking home more. Also, it would greatly simplify tax returns. What's not to like? It has the backing of a bipartisan group from Tom Coburn to Dick Durbin, and the President even supports it. (My guess is only because he commissioned it, but I don't know.) House Republicans should be able to pass it as a package with an up-or-down vote, with no pork, and while the Senate may need to buy off some votes with pork, it won't be the crapfest that the Bush tax cut extension has become. Let's see if Republicans have learned their lesson.

A blog about the views, actions, and bemusements of the Pitchfork and Musket Junta, an informal conservative think tank.

Showing posts with label Congress. Show all posts

Showing posts with label Congress. Show all posts

Monday, December 13, 2010

Friday, October 29, 2010

How the new Republican Congress can work with President Obama

Wednesday morning, we will wake up to a House of Representatives and potentially a Senate taken over by Republicans. Republicans have opposed all of the unpopular programs that President Obama has promoted and will be rewarded by the American people. Democrats and the liberal talking point repeaters have reminded everyone that will listen over and over that opposition to unpopular programs is not governing, and a Republican-majority Congress will have to govern. They're right. But it should be noted that the American people are not sending this new Congress to add Federal programs and laws and regulations, they're sending them to cut the Federal government and repeal laws and regulations. This election is a mandate to increase freedom. But with divided government, to make those cuts and repeal those laws and regulations, it will take bipartisanship. Speaker Boehner (or whoever) will have to work with President Obama, Democrats in the Senate (even if Republicans do take back the Senate, it will be narrow), and probably some House Democrats. To get this started on the right foot, I have a simple proposal: Make the cuts that the Democrats ask for first. Go to the President, and Democrats in Congress, and ask for a list of government programs and bureaucracies to cut (whole or partial), and laws and regulations to repeal. Everything should be on the table. Make those cuts first. This won't be enough, but it will be a start, and a start on the right foot. If Republicans let Democrats take some credit for the low-hanging fruit cuts, they should be more willing to work with Republicans when the cuts get harder. The current fiscal and economic mess is a hole that was dug in a bipartisan fashion. We'll need bipartisanship to get out of it.

Saturday, February 7, 2009

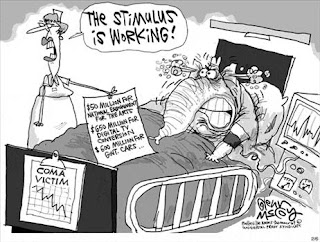

The Most Egregious Act of Generational Theft in History

Question: What's the difference between a Donkey and a RINO?

Answer: About $100,000,000,000 of future taxpayers' money. That's the amount of money that Democrats cut out of the $800+ Billion pork/welfare/state bailout/Medicaid/public art/maybe a little bit of infrastructure bill to get Arlen Specter, Susan Collins, and Olympia Snowe to jump in with both feet. The bill that Congresscritters are calling a stimulus bill, despite the fact that Congressional Budget Office calls it harmful to the economy over the long term. (I figure that John McCain was holding out for another $15).

You've seen them in action. 61% of the Senate, and 56% of the House will shackle an enormous national mortgage to the the feet of their children to grow their own power. It is taxation without representation.

(Thread title borrowed from Tom Coburn's excellent op-ed on the same topic.)

Answer: About $100,000,000,000 of future taxpayers' money. That's the amount of money that Democrats cut out of the $800+ Billion pork/welfare/state bailout/Medicaid/public art/maybe a little bit of infrastructure bill to get Arlen Specter, Susan Collins, and Olympia Snowe to jump in with both feet. The bill that Congresscritters are calling a stimulus bill, despite the fact that Congressional Budget Office calls it harmful to the economy over the long term. (I figure that John McCain was holding out for another $15).

You've seen them in action. 61% of the Senate, and 56% of the House will shackle an enormous national mortgage to the the feet of their children to grow their own power. It is taxation without representation.

(Thread title borrowed from Tom Coburn's excellent op-ed on the same topic.)

Labels:

budget deficit,

Congress,

pork,

thieves,

Tom Coburn

Subscribe to:

Posts (Atom)